Assad Wealth Management vs. Robo-Advisors

In a world of instant gratification, money management has followed the same trend. DIY platforms and robo-advisors like Wealthsimple and Wahed have made Halal investing more accessible for Canadian Muslims. That accessibility is a welcome development, but for families, professionals, and business owners managing significant and growing wealth, there is a dangerous gap between an easy-to-use investment tool and a comprehensive, faith-aligned financial plan.

Robo-advisors can provide low-cost portfolios and automated rebalancing. What they cannot do is understand your family dynamics, your business complexity, your Zakat obligations, or your long-term vision for Deen and Dunya. Real financial advice is about more than picking Shariah-compliant stocks; it is about the confidence that you and your loved ones will continue to thrive across every dimension of your life. At Assad Wealth Management, bridging that gap between Deen (faith) and Dunya (worldly life) requires a specialized Advisor, not just an algorithm.

When a Robo-Advisor Is (and Isn’t) Enough

For a young professional with a single T4 income, no dependants, and a modest portfolio, a robo-advisor can be a reasonable starting point. You answer a questionnaire, get a diversified Halal portfolio, and benefit from low fees and automated rebalancing. For simple situations, that may be sufficient.

Complexity changes everything. Once your life includes a practice or Business, multiple income sources, corporations or holding companies, rental properties, cross-border issues, or multi-generational goals, a robo-advisor’s mandate remains narrow: invest your account, not understand your life. It will not:

Coordinate with your accountant or lawyer.

Structure your compensation and withdrawals across entities.

Integrate inheritance, philanthropy, and Zakat into a unified strategy.

Help your family navigate a death, business exit, or health crisis.

If you answer “yes” to two or more of the following, your needs are likely beyond what an algorithm can deliver:

Do you own or plan to own a business or professional corporation?

Do you have a spouse, children, or parents financially dependent on you?

Do you hold, or expect to hold, significant assets in corporations, real estate, or multiple accounts?

Do you want an integrated Zakat and Halal strategy, not just a “Muslim-friendly” portfolio?

Do you anticipate a business sale, inheritance, or major liquidity event?

If so, “one-click” investing alone can leave serious gaps that only become visible when it is too late.

Tenure Over Theory: Why Experience Matters

Accreditation is the starting line; experience is the finish line. It is one thing to read about the 2008 market collapse in a textbook; it is another to have led families, Retirees, and business owners through it in real time. Market history since then has included the global financial crisis, the oil crash, the 2020 pandemic shock, inflation spikes, and rapid rate hikes. Each event tested investors’ discipline in different ways.

With over 20 years of experience, our team has navigated multiple regulatory shifts and market downturns. That tenure matters when headlines turn volatile. Algorithms rebalance; advisors coach. At Assad Wealth Management, we do not just manage assets; we help manage the uncertainty that comes with building a multi-generational legacy by:

Translating market events into plain language tied to your plan.

Challenging reactive decisions (panic selling, speculative trends).

Adjusting strategy when your life not just the market changes.

The Quantitative Value of Advice

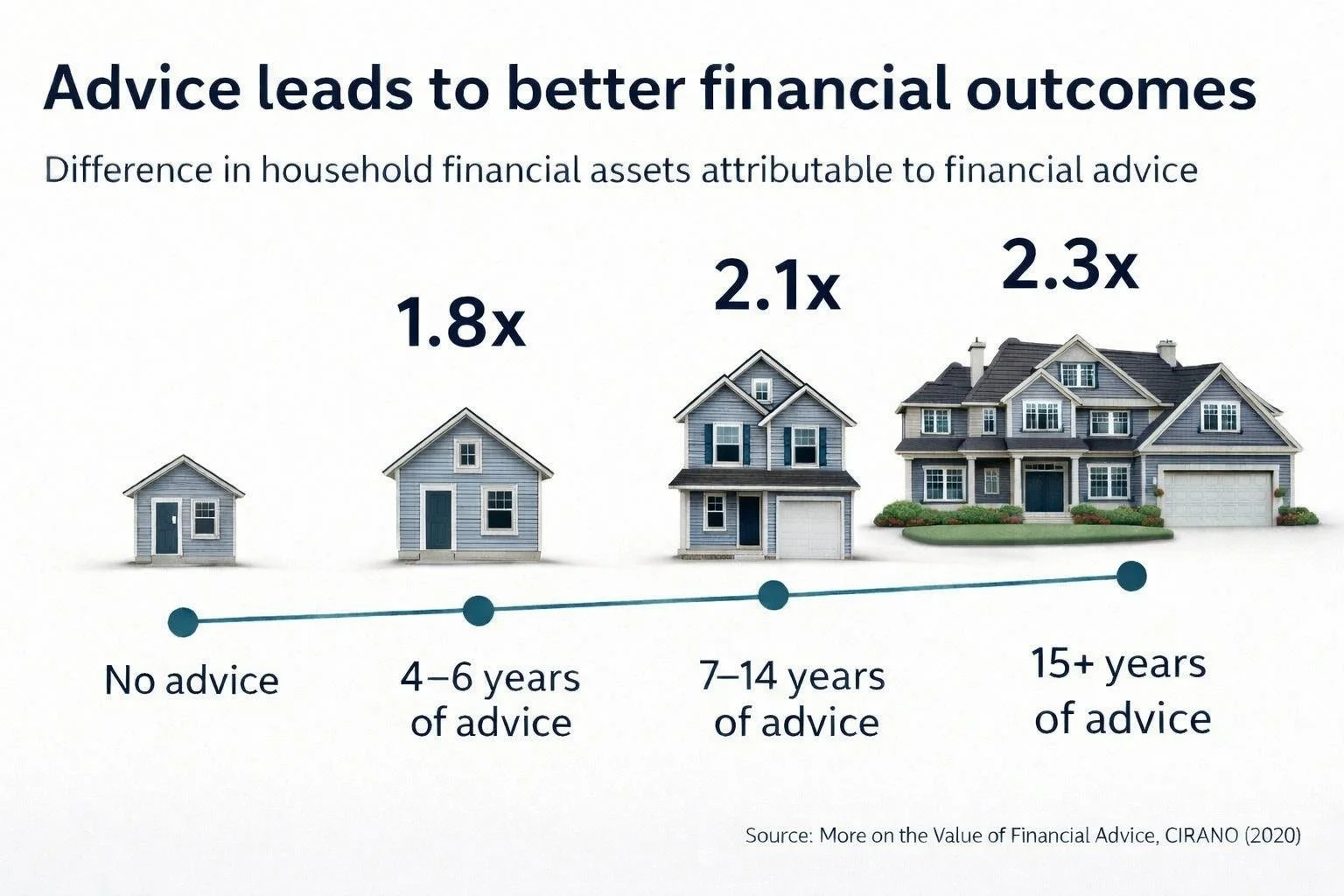

The cost of professional advice is often far lower than the cost of a missed tax opportunity or an emotional, poorly timed decision. While this is intuitive, a 2020 CIRANO report found that Canadian households who work with a financial advisor hold dramatically more financial assets than comparable households without advice, with the advantage growing the longer the relationship lasts.

The report shows that Canadian households working with a financial advisor accumulated roughly 1.8 times more financial assets after 4–6 years, 2.1 times more after 7–14 years, and about 2.3 times more after 15 years or longer of receiving advice.

The 90/10 Rule: Investing Is Behavioral

Investing is often described as 10% science and 90% psychology. Asset allocation, Shariah screens, and product selection are important, but they are not the primary reason many investors fall short of their goals. The main culprit is human emotion, fear in downturns and greed in booms.

Robo-advisors can automate rebalancing, but they do not provide true behavioral coaching. When markets fall sharply, your phone still lights up with alarming notifications and headlines. In those moments, a dashboard cannot talk you through whether to hold, rebalance, harvest tax losses, or revisit your risk level in the context of your broader life. Our role is to separate our clients from their money emotionally. Acting as a buffer between you and the “noise” of the market helps you make objective, rational decisions anchored in your long-term values and goals.

Beyond Portfolios: The IG Living Plan™

Many advisors only look at your portfolio. We look at your life. Through the IG Living Plan™, we coordinate six key dimensions of your financial well-being so your strategy functions as a coherent whole rather than a collection of accounts:

Optimizing Your Retirement: Designing tax-efficient income and withdrawal strategies that match your unique vision for retirement, including timing of RRSP/RRIF, TFSAs, corporate distributions, and government benefits.

Maximizing Business Success: For Business Owners, evaluating corporate and ownership structures to improve wealth accumulation and plan for tax-efficient transitions or eventual sale.

Sharing Your Wealth: Aligning your philanthropic goals and estate objectives to preserve family harmony and minimize tax, including Islamic inheritance considerations where appropriate.

Managing Cash Flow: Developing strategies to optimize debt, align financing with asset mix, and implement advanced borrowing solutions to prudently build wealth.

Preparing for the Unexpected: Analyzing risk exposure (life, disability, critical illness) to protect your standard of living and your family’s future.

Planning for Major Expenditures: Structuring funding strategies for major goals such as a vacation property, children’s education, or a new business venture.

A plan is never “set and forget.” Monitoring and Evolution is built into our process; we are responsible for checking your progress at regular intervals, celebrating success, and proactively identifying necessary changes as your life, family circumstances, and markets shift.

Client Success Story

Batcha Mohamed, a busy engineer and business owner based in Alberta working 14–15 hour days, felt overwhelmed, imbalanced, and anxious about managing his wealth in a halal way while meeting obligations like Zakat, RRSP/RESP contributions, and family needs.

Meeting Hash Assad in 2017 was, in his words, “a miracle… at the perfect time,” as Hash built a comprehensive IG Living Plan™ that aligned Batcha’s finances with Islamic principles, coordinated personal and business planning, and became his one-stop shop for all financial needs.

This gave Batcha “ease of mind,” a “calmness in his heart,” and trust so strong that he rarely checks his accounts himself, saying, “If Hash hadn’t been there, I’d always be worried… whether the money that is coming to me is being invested in a halal source… and whether I’ll have the stability to look forward in life.”

Today he is debt-free, enjoying strong returns and reliable liquidity, “He has given me amazing returns. He has grown my money and taken care of all my liabilities” while having the time and resources to grow his business, support causes like his father’s educational project, and focus on worship and Islamic studies, calling the relationship “a perfect match” and saying, “He is perfect. You can sit back and relax and do whatever you wanted to do.”

Faith, Zakat, and Halal Wealth

For Muslim families, wealth is not judged only by after-tax returns but by whether it remains Halal, purified through Zakat, and consistent with a life of worship. Many “Halal” robo-advisors stop at index screening, leaving the rest of your financial life, corporations, real estate, retained earnings, pensions, and legacy planning outside any meaningful faith-based framework.

At Assad Wealth Management, faith is built into the planning process, not layered on top at the end. Your investments, accounts, and giving strategy are coordinated so that Deen and Dunya stay aligned as your wealth grows.

Shariah-compliant funds address investments. But Zakat on modern wealth, RRSPs, TFSAs, corporate accounts goes far beyond index screening. And your giving strategy, inheritance planning, and debt management are separate from fund selection. A robo-advisor provides a Halal portfolio. We provide Halal wealth.

Integrated Zakat Planning: Zakat is complex, and most Muslims are left to figure it out on their own once a year. In Islamic tradition, wealth comes with responsibility. Not just to grow it, but to purify it, share it, and leave it with integrity. A robo-advisor treats your wealth as a math problem. We treat it as a life responsibility.

Instead of treating Zakat as an afterthought, we:

Help you identify what is and is not Zakatable across personal and business assets, and translate that into a clear annual obligation.

Build your Zakat date, cash-flow needs, and record-keeping into your broader financial plan so you are not scrambling each Ramadan or Hijri year-end.

Provide a structured process you can revisit each year, so as your balance sheet evolves, your Zakat remains accurate and your wealth remains spiritually “clean.”

Values-Driven Structuring: Halal investing is more than avoiding conventional interest or a few prohibited sectors. It is about how you borrow, how you structure companies, how you hold surplus cash, and how you balance growth with principle. We review:

How debt, leverage, and financing structures intersect with your ethical and religious commitments.

How to position corporate, real estate, and investment holdings so they support, rather than undermine, your Halal objectives.

The goal is a balance sheet that makes sense to both your accountant and your conscience.

Legacy, Sadaqah, and Donor-Advised Giving: As wealth grows, so does the responsibility to use it for lasting good. We help you move from ad‑hoc donations to a thoughtful giving strategy by:

Designing a repeatable approach to Sadaqah and long-term charitable commitments that fits your cash flow and long-range goals.

Using structures like donor-advised funds to centralize your giving, plan grants over time, and involve your children in decisions so generosity becomes a family practice, not just a line item.

Coordinating your giving with your estate and inheritance planning so what you leave behind reflects both your financial capacity and your spiritual aspirations.

This is not “Muslim branding” on a generic portfolio. It is a holistic, faith-first approach to wealth: one that treats Zakat, Halal investing, and legacy giving as core design constraints rather than marketing labels.

Strategic Partnerships: Innovation in Wealth

To better serve clients, we have moved beyond traditional boundaries by integrating carefully selected strategic partners that address specific pain points:

interVal: Your Business Valuation Solution: Through our partnership with interVal, eligible business owners can access technology that provides an up-to-date valuation range, key ratios, and a “saleability score” to indicate how attractive your business might be to potential buyers. This helps connect your corporate value to your personal retirement and estate planning.

ClearEstate Partnership: Estate settlement is complex, time-consuming, and emotionally taxing. Our collaboration with ClearEstate supports executors and families with a tech-enabled, empathetic process to navigate probate and administration more efficiently and with fewer costly mistakes.

Integrated Planning Around These Tools: Rather than leaving you with another dashboard, we incorporate the insights from these platforms directly into your IG Living Plan™ and your estate, tax, and succession strategies.

Cost vs. Value: A Transparent Trade-Off

Robo-advisors are usually cheaper on paper. Their value proposition is clear: lower fees, automated portfolios, less friction. For simple needs, that trade-off may be rational. For complex lives and substantial wealth, the question is not “Which is cheapest?” but “Which decision is costliest if something goes wrong?”

The real cost drivers over a lifetime often include:

Missed or suboptimal tax planning.

Poorly structured business exits or successions.

Inadequate risk protection or estate planning.

Emotional decisions during market stress.

The cost of professional advice is often far lower than the cost of a single large mistake or missed opportunity. A well-designed plan seeks to more than earn its keep through tax efficiencies, risk reduction, and better long-term decision-making.

If professional advice helps you properly rebalance your portfolio, optimize your tax strategy, avoid over-contributing to registered accounts, put the right estate planning documents in place including wills, powers of attorney, and personal directives, plan for major upcoming expenditures, uncover a $30,000 insurance gap before it becomes a tragedy, or structure a future business exit that avoids $50,000 in unnecessary taxes, the fee has paid for itself many times over. Most of our clients see quantifiable value within weeks.

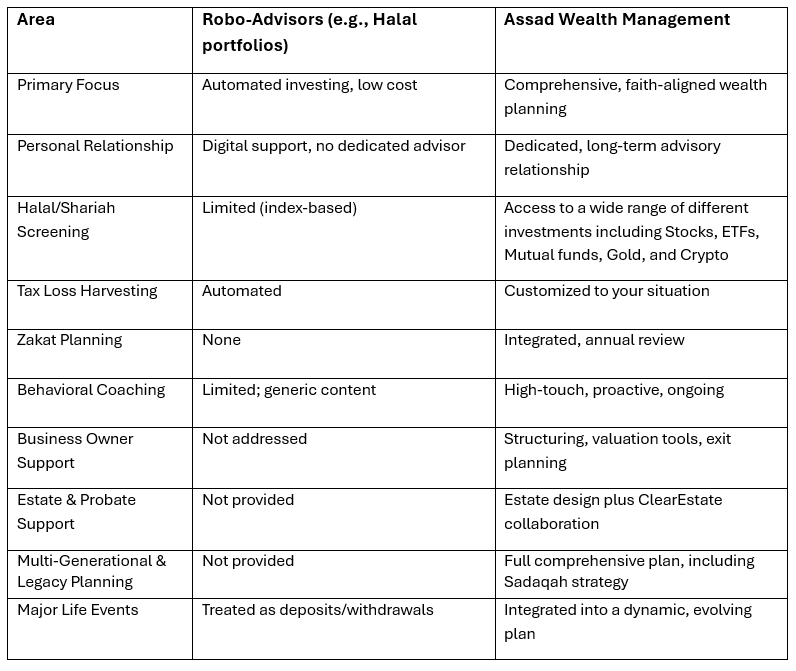

Assad Wealth Management vs. Robo-Advisors at a Glance

Choosing Your Path

Robo-advisors have an important place in the ecosystem. For some investors, they may be a good starting point. For Canadian Muslims navigating complex wealth, family responsibilities, and interconnected business and faith commitments, the stakes are higher.

If you see your life reflected in the complexities described here, a conversation with a human Advisor who understands both Deen and Dunya may be your most valuable next step.